There is a big lawsuit brewing in the center of Brooklyn, NY about – of all things – a beverage that can only be made 2,585 miles away. A hefty law firm, with about 80 lawyers and 10 US offices, filed suit against Diageo about how much agave distillate is and should be in their top-selling Casamigos and Don Julio brands of Tequila. The suit was filed May 5th in the U.S. District Court for the Eastern District of New York. With a claim of false marketing, the plaintiffs allege that these products tell consumers that the products are made from 100% (expensive) Blue Weber Agave even though they have “significant concentrations of cane or other types of alcohol. …”

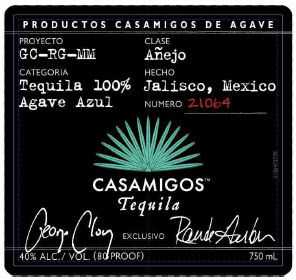

The 22 page complaint backs up this bold assertion, so far, by pointing to press accounts saying thousands of agave farmers in Mexico have been angrily and publicly protesting the use of various sources of alcohol other than agave, such as corn and cane, in various high-end Tequilas. The complaint alleges that lab testing verifies the use of other-than-agave-distillates. A recent label approval for Casamigos Tequila shows how the brand label states “Tequila 100% Agave Azul.”

The complaint stops short of pounding the table, and it probably does not need to do so. The defendants may be forced to admit or deny what is alleged. Beyond that, discovery and further testing should paint a very clear and revealing picture of what is really happening here. The implications seem at least as big as in the Tito’s Vodka case of recent years, because Diageo is huge, the brands are massive, Tequila is a giant category, this could balloon to be a nationwide class action suit, famous people are involved, and the laws of quite a few countries could be significantly implicated before all is said and done. The complaint mostly points to New York and New Jersey law. TTB’s relevant rules (about Tequila) are fairly sparse and deferential to Mexico. They say Tequila is “[a]n agave spirit that is a distinctive product of Mexico. Tequila must be made in Mexico, in compliance with the laws and regulations of Mexico governing the manufacture of Tequila for consumption in that country.”

Felisa Rogers has a large amount of helpful background on these issues, published over the past few months at Mezcalistas. The complaint relies significantly on two of her articles from early 2025. She says:

The agaveros are making a very serious accusation when they suggest that the CRT is allowing tequileros to cut costs by mixing cane alcohol into tequila and labeling it as 100% agave. Although so-called mixto tequila can legally contain 49 percent sugar from other sources, this sugar must be added during the fermentation process. “Cold blending” tequila with other alcohols is illegal. …

For nearly 30 years, the tequila industry has enjoyed a reputation for producing one of the most closely regulated spirits on the planet. In 1994, the CRT was founded to enforce consistency in an industry that had developed a reputation for rotgut.

The agency set to its job with a vengeance. The CRT hired customs certifiers to bust exporters of fake tequila at the US border. In Mexico, CRT officials implemented a stringent system of quality control that included requiring licensed farmers to document every single agave planted (including GPS coordinates) and apply for a verified “passport” to transport agave. They assigned an inspector to every distillery, and mandated that every batch of tequila be tested in a lab to ensure that it meets quality standards.

As Sarah Bowen wrote in Divided Spirits, “The combination of increased quality control by the CRT and its strategic partnerships with government agencies contributed to improvements in tequila’s reputation and a decline in the production of uncertified tequila.” Tequila began its meteoric ascent in popularity and status.

The case is only four days old and so there is not a lot of other information in the docket report so far. For example, there is no court response from the defendants to date. But this case is almost certain to be of major importance, and illuminating, for many months or years to come. Outside of court, Diageo has said “these claims of adulteration are outrageous and categorically false.”

We look forward to sharing the other sides of this story.