As an additional response to the burdens that COVID-19 is placing on alcohol beverage industry members, TTB has issued Industry Circular 2020-2. The Circular postpones several filing and due dates where the original date falls on or after March 1, 2020 through July 1, 2020. TTB published the Circular on March 31.

As an additional response to the burdens that COVID-19 is placing on alcohol beverage industry members, TTB has issued Industry Circular 2020-2. The Circular postpones several filing and due dates where the original date falls on or after March 1, 2020 through July 1, 2020. TTB published the Circular on March 31.

Per the Industry Circular TTB is, among other considerations:

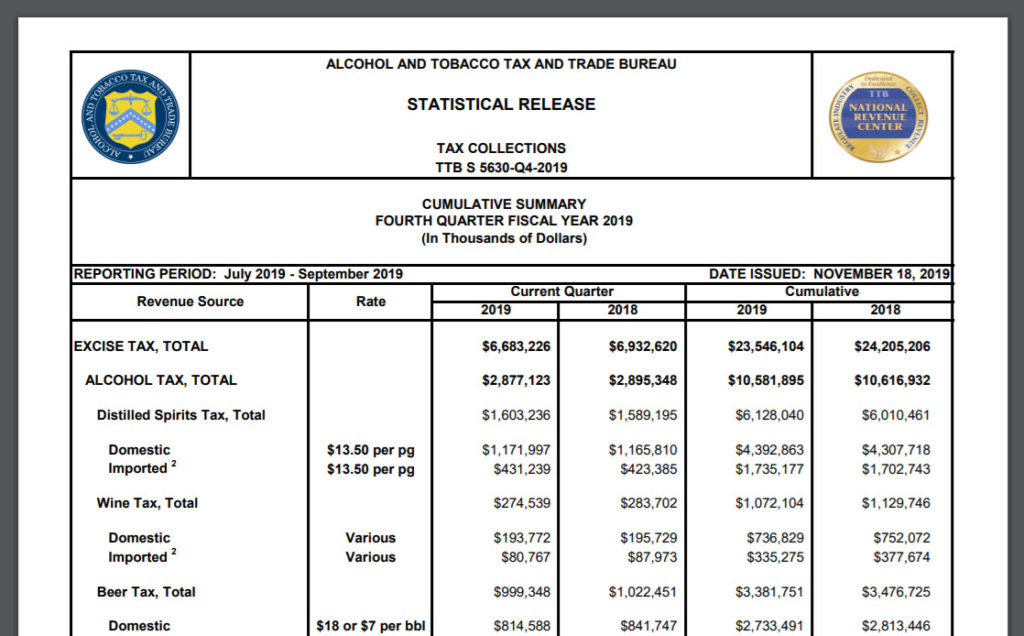

- Postponing tax payment due dates for wine, beer, and distilled spirits excise taxes.

- Postponing filing due dates for excise tax returns.

- Postponing filing due dates for submission of operational reports.

- Postponing filing due dates for claims for credit or refund by producers.

- Postponing filing due dates for claims by manufacturers of nonbeverage products.

- Postponing due dates for submission of export documentation.

See TTB Industry Circular 2020-2.

The due dates and filings are postponed for 90 days from the due date otherwise prescribed. For example, if your DSP operational report is due on May 15, 2020 it is now postponed until August 13, 2020. Attachment A to Industry Circular 2020-2 provides a list of excise tax payment and filing dates with a corresponding postponement date. Attachment B to Industry Circular 2020-2 provides a list of new due dates for postponed operational reports.

So now it’s not only the (infinite?) amount of cash the federal government is shelling out, but the amounts of money not collected, that are staggering.

Federal guidance is coming at a fast pace as everyone adjusts to the demands and burdens resulting from COVID-19. TTB has a dedicated COVID page here, and it already has more than a handful of policy updates.

We are still healthy and still working, though we are starting to miss the office and we absolutely regret missing the various industry conventions. We are helping our clients navigate through these uncertain times and to the extent you need assistance or have questions, let us know and we will see how we can best help.

Leave a Reply