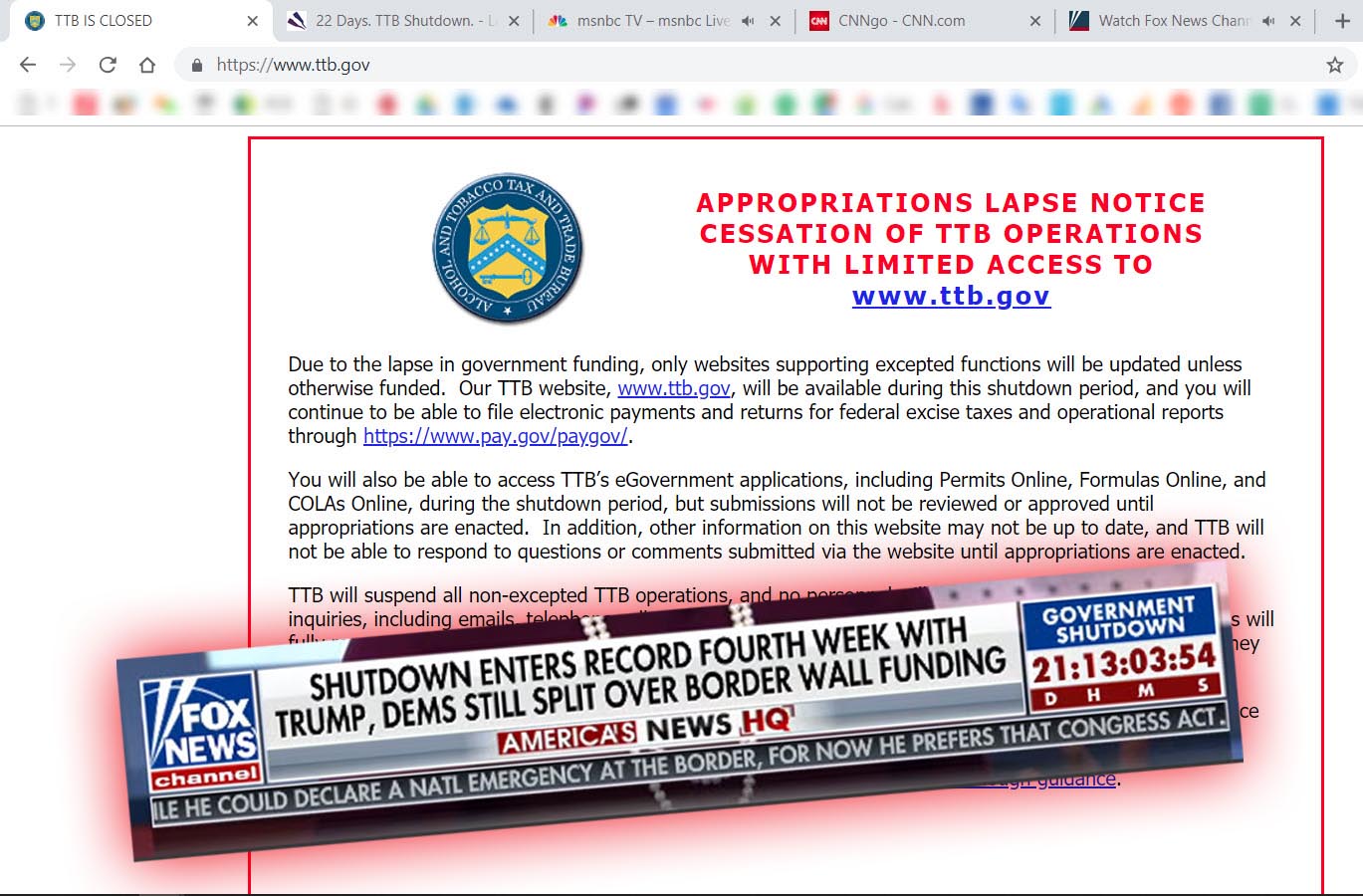

TTB has been shut for 22 days now. This is the longest in anyone’s memory, or ever.

Few things are more heavily regulated than booze in America, so the impacts are correspondingly severe.

- Labels. Anyone with a login can submit labels as per normal. But nobody is going to review or approve them until TTB reopens. This is hundreds of beer, wine and spirits labels normally submitted per day. Just when TTB was bringing the normal processing time down to comfortable ranges, when anxiety and expedites were fading, we can expect long lines and much consternation.

- Formulas. About the same as labels above.

- Permits. More of the same.

Beer is getting a lot of the attention in the mainstream press. TTB beer label delays were on the front page of The Wall Street Journal this morning. And The New York Times a few days ago. And nobody should miss the Colbert segment on beer labels, TTB, and shutdown delays. Even though beer is getting a lot of the attention, the impacts extend to wine and spirits no less. For example, distilleries waiting on TTB for transfer in bond approvals (required for distilleries to ship bulk untaxpaid alcohol to one another) may not be able to produce some of their...

Continue Reading Leave a Comment